- Technology behind shale shaker screen

innovations - Performance data comparison of industry-leading screens

- Key metrics for evaluating shale shaker screen mesh factories

- Custom engineering approaches for challenging drilling conditions

- Material science breakthroughs in screen durability

- Case studies demonstrating efficiency improvements

- Value proposition of specialized shale shaker screen exporters

(shale shaker screen)

The Technology Powering Advanced Shale Shaker Screens

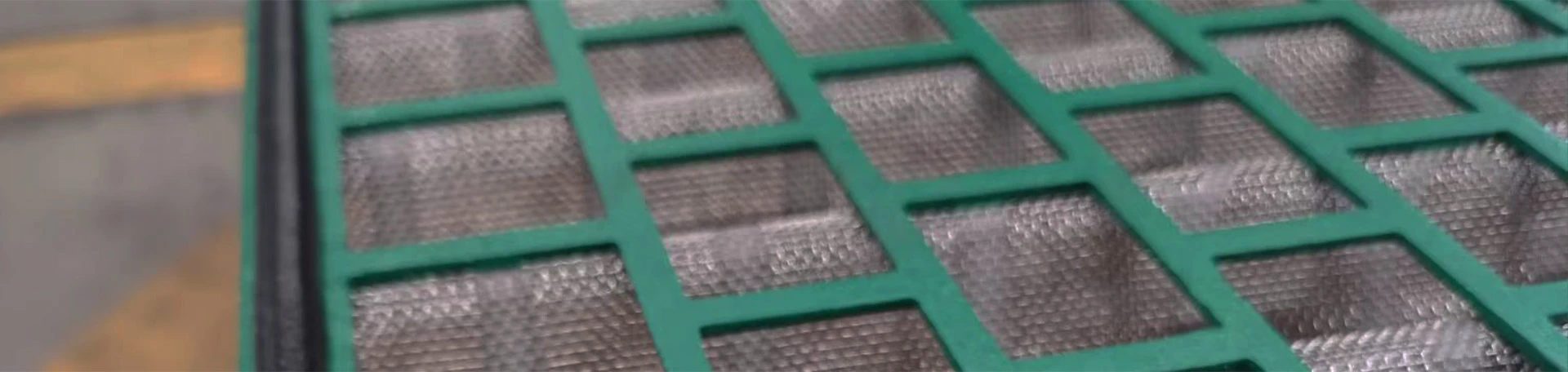

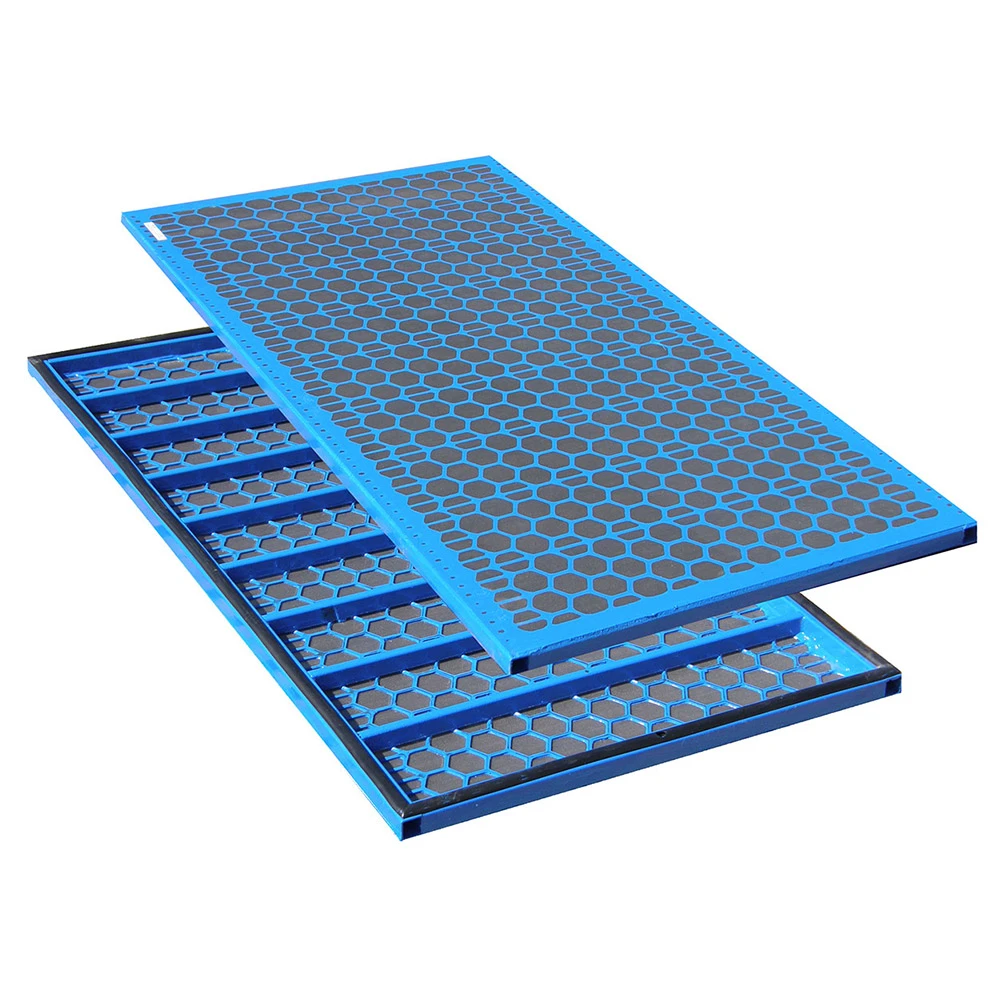

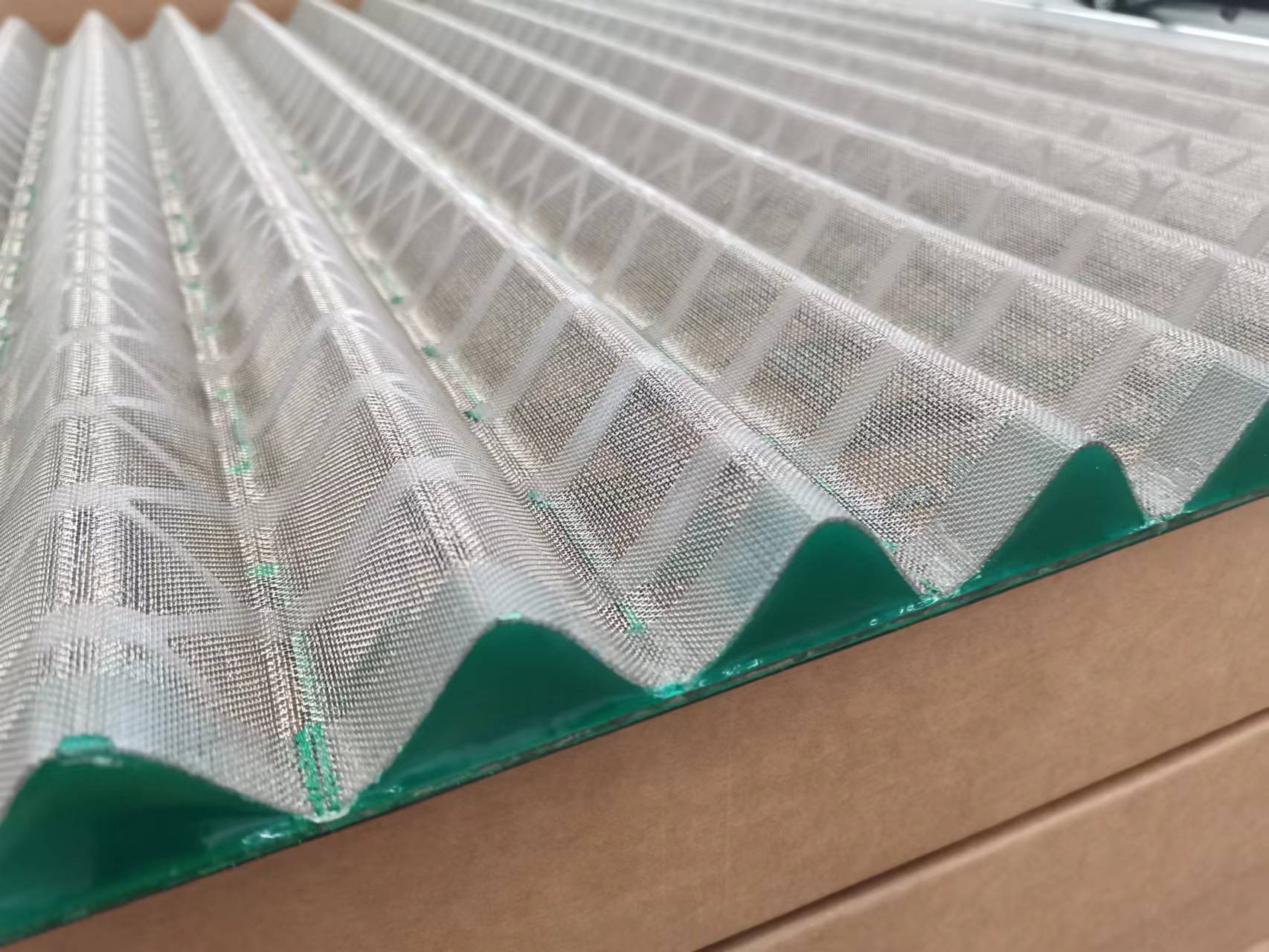

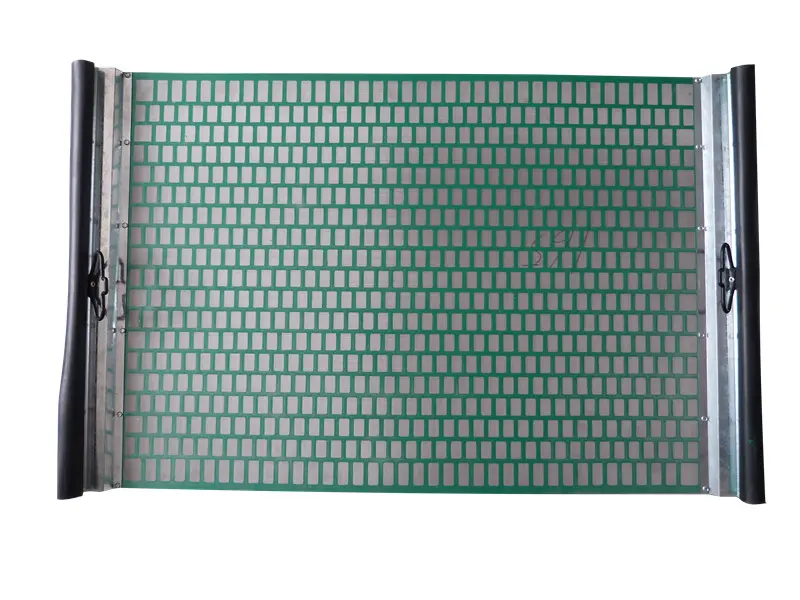

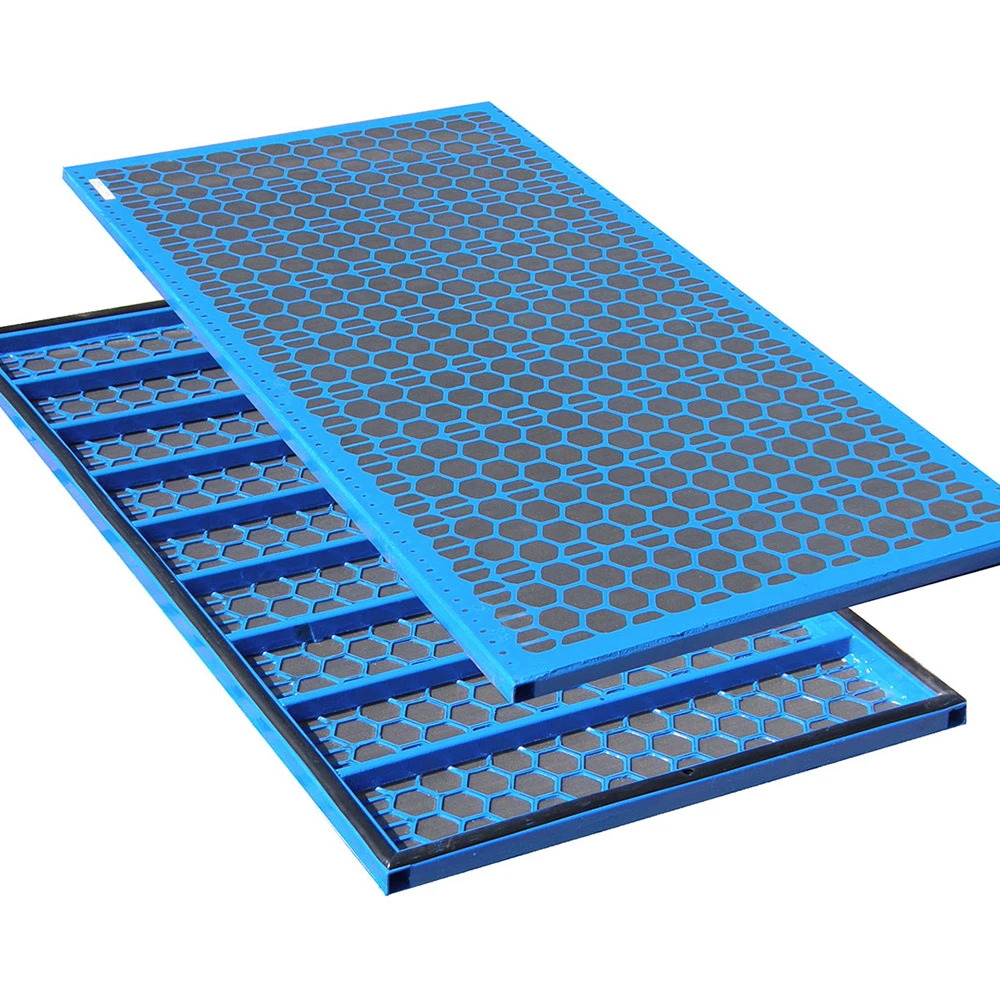

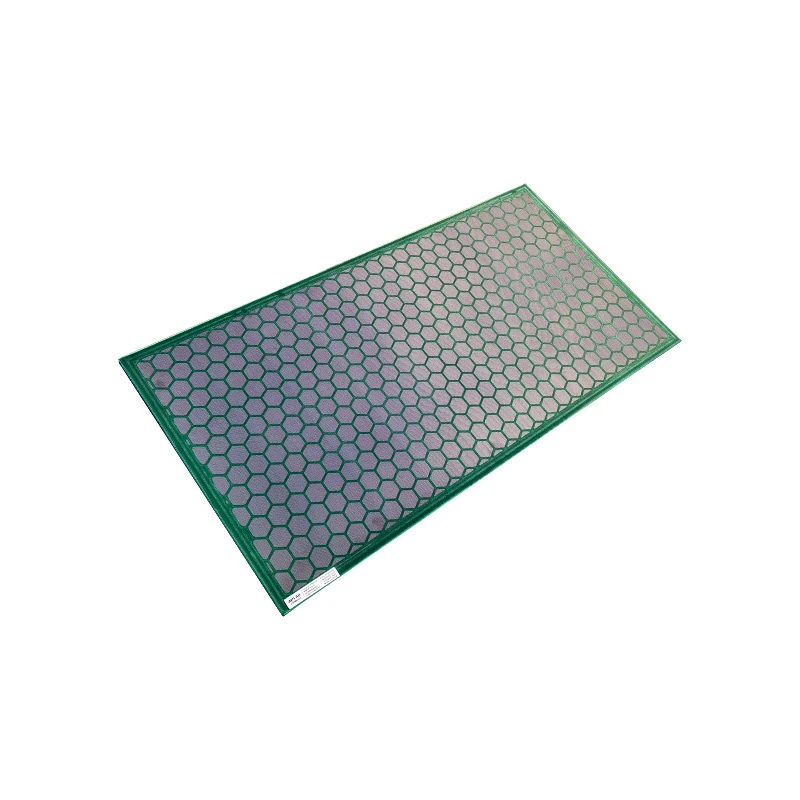

Modern shale shaker screens represent significant engineering advancements beyond basic filtration. Leading manufacturers utilize computer-modeled aperture geometries that optimize fluid dynamics while maintaining structural integrity. These screens employ high-integrity bonding techniques that increase service life by 40-60% compared to standard welded designs. Most premium screens now use multi-layer composite structures with graded mesh configurations – typically combining coarse backing support with fine filtration layers. This architectural approach achieves the contradictory requirements of high throughput and precise particle separation.

Performance Metrics Revolutionizing Drilling Operations

Operational data reveals dramatic efficiency improvements from next-generation screens. Field studies document 27-35% increases in fluid processing capacity when comparing modern screens against traditional options. This enhanced performance directly reduces drilling fluid consumption – a significant cost factor where premium fluids exceed $400 per barrel. Extended service life presents another compelling metric: premium screens typically last 300-500 operating hours versus the industry average of 150-220 hours. This durability directly decreases non-productive time and replacement costs.

| Manufacturer | Flow Capacity (GPM) | Vibration Resistance | Mesh Layers | Avg. Lifespan (hrs) |

|---|---|---|---|---|

| Derrick Hyperpool | 850 | Grade 9 | 3-5 | 480 |

| M-I Swaco XTREME | 790 | Grade 8 | 3 | 420 |

| Standard Industry Screens | 600 | Grade 5 | 2 | 190 |

Evaluating Leading Shale Shaker Screen Mesh Factories

Global screen production facilities differ dramatically in capabilities and quality assurance standards. Top-tier shale shaker screen mesh factories implement automated optical calibration systems that ensure micrometer-level precision in weave patterns – achieving consistency rates above 98.7%. Environmental control during production proves equally critical; premium manufacturers maintain humidity-controlled environments to prevent material distortion during curing processes. Production scale matters considerably: factories capable of 200,000+ units annually typically offer superior supply chain reliability, yet specialized low-volume producers often excel in custom applications requiring unique alloys or non-standard dimensions.

Custom Engineering Solutions for Extreme Conditions

Specialized drilling environments demand tailored screen solutions that standard products can't address. In abrasive formations encountered in Canadian oil sands operations, manufacturers developed boron-carbide reinforced edges that increased wear resistance by 400%. For arctic operations, material scientists created polymer-infused metal weaves that maintain flexibility at -60°F without compromising tensile strength. Deepwater drilling scenarios prompted innovations like asymmetrical tensioning systems that compensate for vessel motion on floating platforms. These custom solutions typically add 15-25% to production costs but prevent operational losses exceeding 200% of screen expenses when standard equipment fails prematurely.

Material Advancements Enhancing Screen Longevity

The most significant breakthroughs involve novel materials and composites. Dual-phase stainless steel alloys now dominate high-end screens, providing chloride resistance essential for offshore applications. Some manufacturers incorporate carbon nanotube reinforcements that increase fatigue resistance by 70% compared to conventional stainless screens. Surface treatments like PVD (Physical Vapor Deposition) coatings reduce blinding tendencies by creating micro-smooth pore surfaces where particles don't adhere. Accelerated aging tests demonstrate that these material innovations extend mean-time-between-failure from 800 to over 2,000 operational hours under simulated downhole conditions.

Proven Applications Transforming Drilling Efficiency

The Permian Basin case study demonstrates practical benefits: after upgrading to advanced composite screens, operators reported 42% reductions in screen-related downtime while achieving 18% higher drilling speeds. Offshore Brazil operations documented processing of weighted muds (18 ppg) with 96% separation efficiency versus the previous 87% benchmark. Perhaps most impressively, geothermal drilling in Iceland's corrosive environments showed screens lasting entire well campaigns without replacement – previously requiring 3-4 changeouts. These documented successes validate the technological investments behind modern shale shaker screens.

The Advantage of Established Shale Shaker Screen Exporters

Experienced shale shaker screen exporters provide indispensable logistical and regulatory expertise beyond manufacturing. They manage complex international shipping requirements including HS code classifications (8421.99.0040), export licenses for controlled alloys, and temperature-controlled transport conditions for polymer-infused products. Established exporters typically maintain buffer inventories at strategic global hubs – enabling 72-hour emergency deliveries to remote locations that would take weeks through standard channels. Furthermore, they handle export compliance documentation, reducing customs delays by 80% compared to direct shipping arrangements. This supply chain mastery proves essential for operations where screen failure means drilling suspension costing over $250,000 daily.

(shale shaker screen)

FAQS on shale shaker screen

Q: What is a shale shaker screen used for?

A: A shale shaker screen is a vital filtration component in drilling operations. It separates solid particles like cuttings from drilling fluids using vibratory motion. This ensures fluid recycling efficiency and protects downstream equipment.

Q: What services do shale shaker screen mesh factories provide?

A: Shale shaker screen mesh factories specialize in manufacturing customized screens for drilling rigs. They produce screens with specific mesh sizes, materials (e.g., stainless steel), and structural designs tailored to geological conditions. Quality control and durability testing are integral to their production process.

Q: How does a shale shaker screen exporter support global drilling projects?

A: A shale shaker screen exporter sources high-performance screens from manufacturers and distributes them worldwide. They handle logistics, certifications (e.g., ISO/API), and provide technical support to clients. This enables drilling teams to access reliable screens promptly across different regions.

Q: Why partner with a shale shaker screen mesh exporter?

A: Partnering with a shale shaker screen mesh exporter guarantees access to diverse screen types, including layered or composite meshes. They ensure compliance with international standards and optimize shipping for minimal downtime. This partnership streamlines supply chains for drilling contractors.

Q: What factors affect shale shaker screen lifespan?

A: Screen lifespan depends on mesh material quality, abrasion resistance, and operating conditions like flow rates. Proper installation and regular maintenance prevent premature failures. Choosing screens matched to drilling fluid properties maximizes longevity.