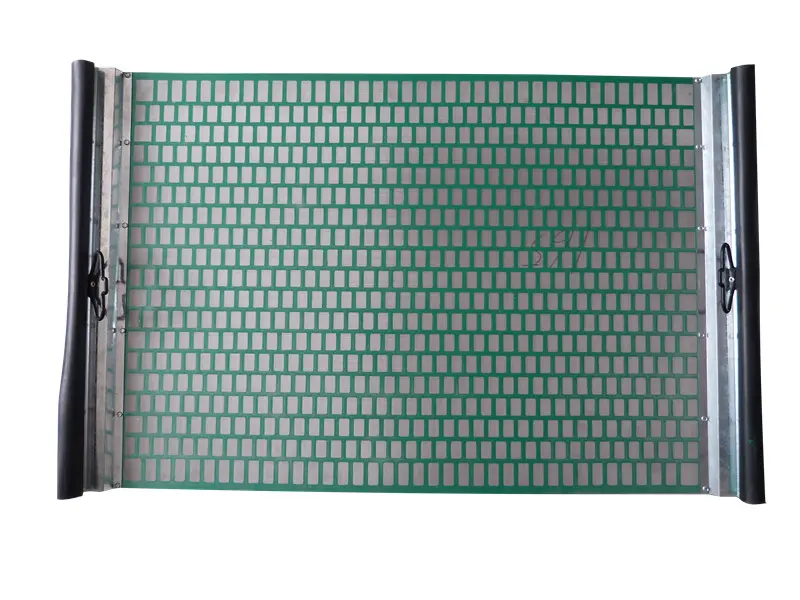

- Introduction to industrial shaker screen supplier

s and the demand in modern industries - Technological advancements in shaker screen manufacturing and mesh selection

- Comparative analysis of leading industrial shaker screen suppliers using data tables

- Custom solution design and material selection in shaker screen supply

- Industry applications: Case studies from oil & gas, mining, and construction

- Best practices for choosing a reliable shaker screen mesh supplier

- Conclusion: Choosing the right industrial shaker screen supplier for business success

(industrial shaker screen supplier)

Market Demand and the Role of Industrial Shaker Screen Suppliers

The global market for shaker screens is projected to grow substantially, driven by the increasing applications across industries such as oil & gas, mining, construction, and recycling. According to a 2023 industry report, the shaker screen market was valued at USD 650 million, with an expected compound annual growth rate (CAGR) of 6.2% through 2028. This surge is due to the demand for efficient solid-liquid separation and fine particle screening.

As a critical component in mechanical separation processes, shaker screens help enhance operational productivity by reducing downtime, improving particle separation, and maintaining fluid quality. Reliable industrial shaker screen suppliers play a vital role in providing high-quality screens, tailored mesh configurations, prompt deliveries, and technical expertise for diverse industry requirements.

Key suppliers are not only manufacturers but also solution partners offering aftermarket support, continuous product innovation, and superior customer service, which collectively create a competitive market landscape.

Innovation and Technical Prowess in Shaker Screen Mesh Manufacturing

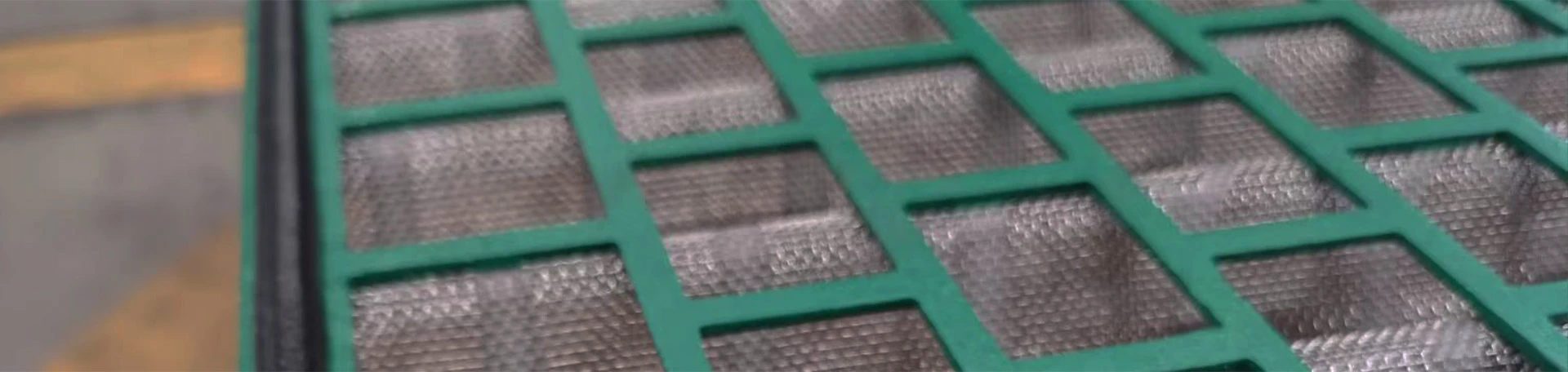

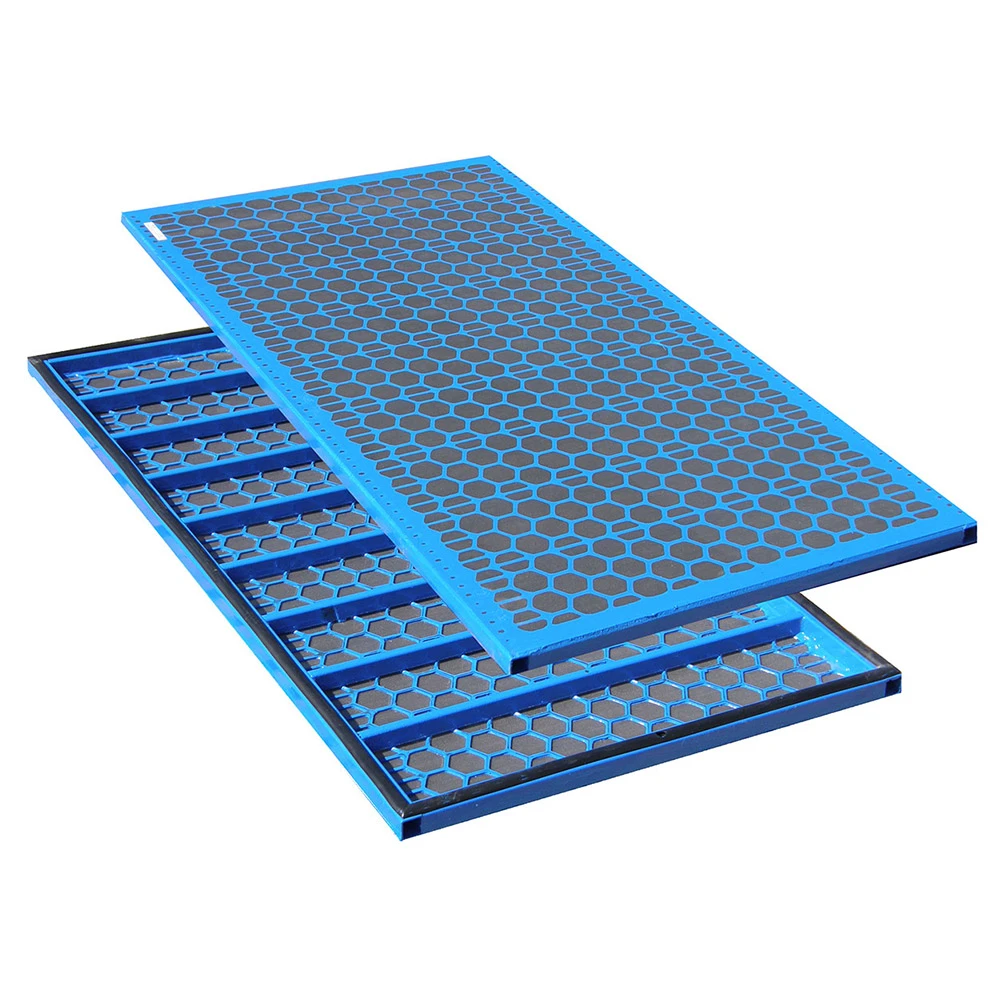

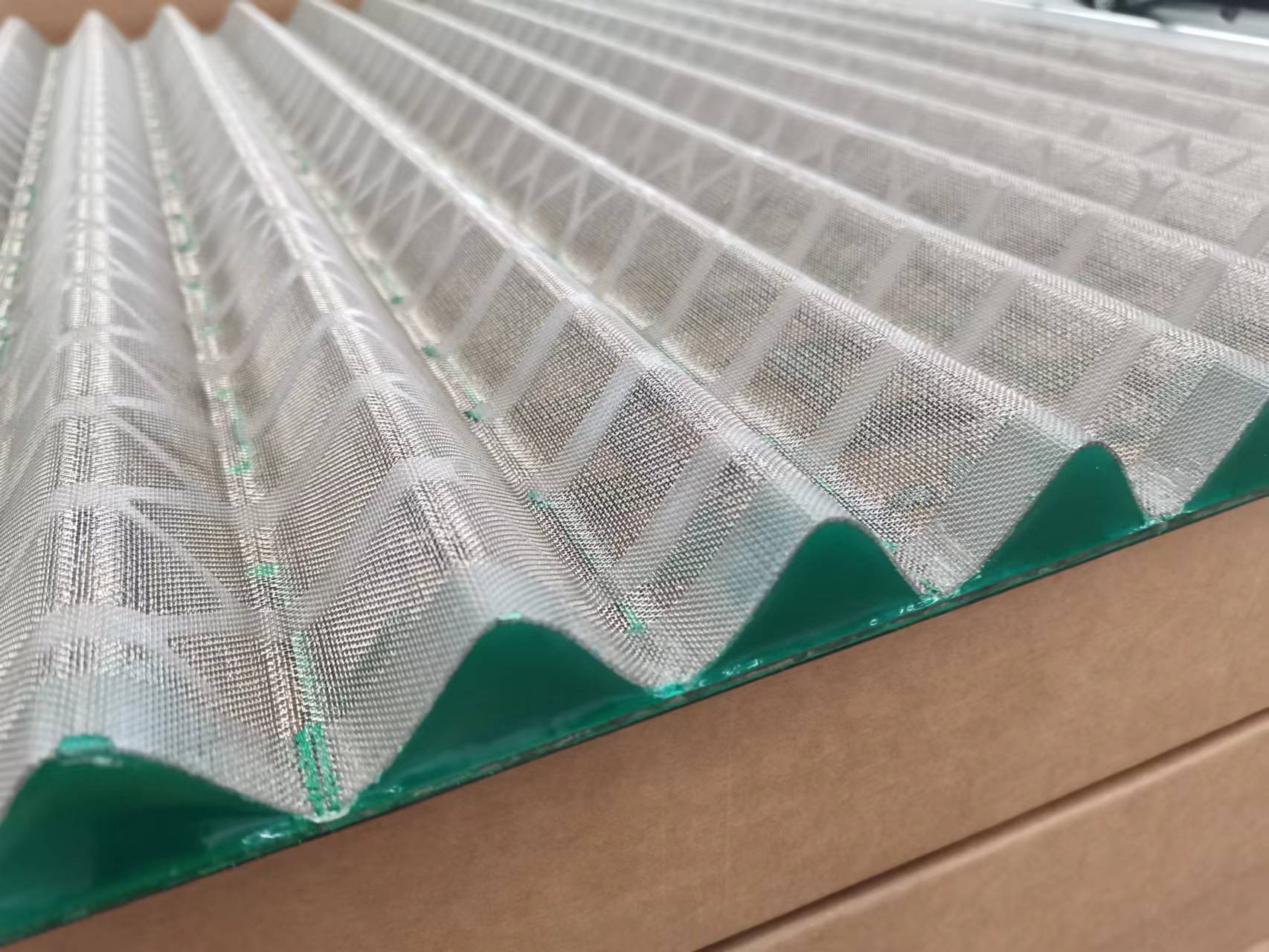

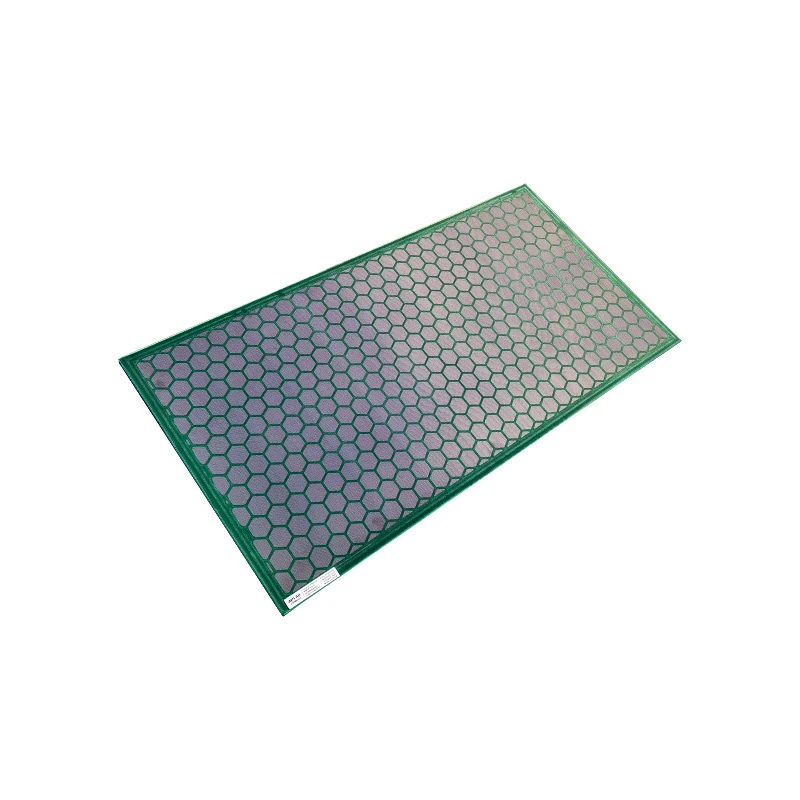

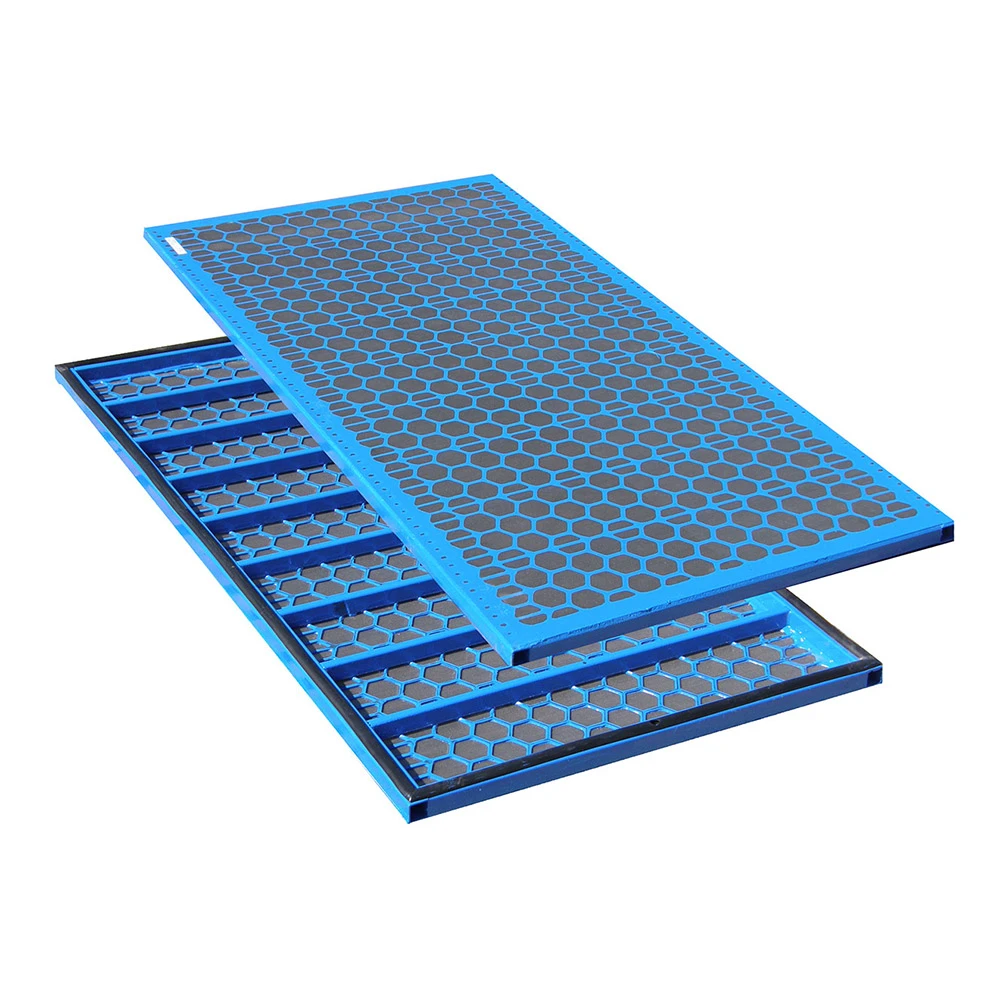

The technological landscape of shaker screen mesh production has evolved significantly over the past decade. Today’s advanced screens utilize multi-layered construction, specialized wire meshes, and synthetic polymers to boost performance. One notable trend is the increasing use of API-certified screens with consistent mesh openings, ensuring predictable operational results across international markets.

Laser cutting and automated welding have largely replaced manual fabrication, improving the dimensional accuracy and durability of shaker screens. Moreover, surface treatments such as anti-corrosive coatings and abrasion-resistant films enlarge the operational lifespan of screens by up to 30%, as reported by industry-wide performance tests.

On the customer side, industries benefit from an expanded mesh selection, ranging from ultra-fine (API 325) to coarse (API 20) screens, facilitating precise adaptation to varying solids-content and fluid properties. Custom woven wire mesh and composite screen technologies further safeguard efficiency, minimizing screen blinding and maximizing throughput.

Supplier Comparison: Data-Driven Insights for Industrial Shaker Screen Procurement

Making an informed decision between leading shaker screen mesh suppliers requires a thorough comparison of critical parameters such as pricing, mesh configuration range, delivery time, after-sales support, and technological innovation. The table below summarizes performance data for four prominent suppliers in the industry:

| Supplier | Mesh Range (API) | Annual Output (Screens/year) | Avg. Lead Time (days) | After-sales Support | Technology Highlights | 2023 Satisfaction Score (1-10) |

|---|---|---|---|---|---|---|

| Supplier A | 20–325 | 250,000 | 10–18 | 24/7 hotline, extended warranties | Composite frame, anti-blinding mesh | 9.3 |

| Supplier B | 20–325 | 180,000 | 15–22 | Online troubleshooting, scheduled site visits | Triple-layer mesh | 8.7 |

| Supplier C | 40–270 | 120,000 | 18–28 | Email support, standard warranty | Stainless steel, standard frame | 7.5 |

| Supplier D | 20–300 | 300,000 | 8–15 | Live chat, on-site technician | Robotic welding, ultra-fine mesh | 9.5 |

Higher satisfaction scores correlate closely with shorter lead times, robust after-sales support, and modern manufacturing technologies. Notably, Supplier D emerges as an industry leader with their streamlined production processes and hands-on technical service.

Tailored Solutions and Material Selection: Meeting Unique Client Needs

Customization is at the core of advanced shaker screen supply strategies. Recognizing that each drilling site or mining operation encounters different solid compositions and volumes, suppliers now offer bespoke mesh configurations and material choices.

For challenging applications—such as handling abrasive minerals or highly corrosive drilling fluids—suppliers may recommend high-tensile stainless steel, polyurethane reinforcement, or composite frames for additional rigidity. Woven configurations can be optimized to reduce “blinding” (where screen openings get clogged), ensuring consistent mesh efficiency over long operation cycles.

Engineering teams work closely with clients to simulate process flows, determine API mesh grades, and select frame materials that address both performance targets and budget constraints. This co-development not only guarantees maximum particle capture rates and throughput, it also controls total cost of ownership.

Application Case Studies: Industry-Specific Use of Advanced Shaker Screens

Across a spectrum of industries, application results underscore the transformative impact of customized shaker screens on process efficiency and operational uptime.

- Oil & Gas Drilling: A Texas-based drilling contractor replaced legacy steel screens with advanced composite options, resulting in a 35% reduction in screen change-outs and a 22% boost in fluid recovery rates over six months, as verified by internal audit.

- Mining Operations: A copper mine in Peru adopted high-tensile polyurethane mesh panels and saw their particle capture efficiency increase from 88% to 97%, leading to 18% fewer pump failures due to reduced solids carryover.

- Construction & Infrastructure Recycling: A major construction debris recycling plant in Germany reduced screen maintenance downtime by 40% after switching to triple-layer, anti-abrasion shaker screens tailored specifically for mixed aggregate separation.

These results highlight how partnership with the right shale shaker screen supplier can drive measurable value in operational resilience and profitability.

Best Practices for Choosing a Shaker Screen Mesh Supplier

Procuring high-performance shaker screens requires a strategic approach to supplier selection:

- Insist on API and ISO certifications for assured screen consistency and safety.

- Review performance guarantees covering both mesh life and fluid throughput.

- Evaluate the supplier’s technical consulting capabilities and on-site service offerings.

- Request samples of mesh panels for laboratory or pilot testing prior to full-scale purchase.

- Consider suppliers who offer sustainable manufacturing practices and recyclability options.

- Assess logistics and inventory management: Reliable suppliers maintain strategically located warehouses for JIT deliveries.

- Study after-market support, including availability of replacement parts and emergency response protocols.

These practices ensure not only initial product quality but also long-term operational reliability.

Conclusion: The Strategic Value of Selecting the Right Industrial Shaker Screen Supplier

As industries demand higher throughput and stricter quality standards, the expertise and reliability of the industrial shaker screen supplier become pivotal to sustained operational success. Through innovation, robust customization, and proven application outcomes, top shaker screen mesh suppliers and shale shaker screen supplier partners help clients maximize recovery, minimize maintenance, and realize greater return on investment.

Data-driven selection and long-term collaboration with market-leading suppliers ensure businesses remain at the technological forefront, equipped for ever-evolving process challenges. For organizations striving for excellence, investing in the right industrial shaker screen supplier is more than a procurement choice—it is a strategic imperative for operational and financial optimization.

(industrial shaker screen supplier)