- Introduction and overview of the brandt shaker pricelist

landscape - Key data and market impact of shaker screen pricing

- Technical advances in shaker screens and their advantages

- Comparative analysis among prominent manufacturers

- Customization options and procurement considerations

- Application case studies illustrating pricing decisions

- Summary and future outlook on brandt shaker pricelist

(brandt shaker pricelist)

Understanding the Brandt Shaker Pricelist Ecosystem

In today's high-demand industrial filtration sector, the brandt shaker pricelist serves as a cornerstone for procurement decisions. The screen price reflects not only material costs but also technological advancements, reliability, and long-term operational value. Procurement managers routinely assess the brandt shaker screens pricelist to ensure alignment with both budgetary constraints and production demands. Constant fluctuations in raw material pricing, assembly automation, and global supply chain patterns ensure that the industrial shaker screen pricelist remains dynamic. Awareness of these core aspects is crucial for organizations seeking sustainable cost-efficiency.

Shaker Screen Pricing Data and Market Influence

Industrial shaker screens play a critical role in solid control systems, directly affecting drilling efficiency and product purity. According to Oil & Gas Filtration Insights 2023, the worldwide average price for standard replacement shaker screens is approximately $70 per unit. However, industry-leading brands, including those under the Brandt umbrella, may command premiums of up to 22% due to proprietary mesh technology and enhanced durability. Globally, the market for industrial shaker screens exceeded $975 million in 2022, underscoring the growing reliance on high-performance components.

| Brand | Average List Price (USD/unit) | Durability (hours) | Screen Types Offered | Lead Time (weeks) |

|---|---|---|---|---|

| Brandt | 85 | 950 | Steel Frame, Composite | 3 |

| MI-SWACO | 79 | 875 | Steel Frame | 2 |

| GN Solids Control | 68 | 700 | Composite, Steel Frame | 4 |

| Deruite | 62 | 640 | Steel Frame | 5 |

| Pyramid Screens | 93 | 1200 | Pyramid, Flat, Composite | 2 |

The table draws a clear distinction between high-end and mid-market brands, demonstrating how pricing interrelates with features like lifespan, technology variety, and supply chain speed. Demand for increased mesh precision and composite screens is also pushing average prices higher, especially in North America and the Middle East.

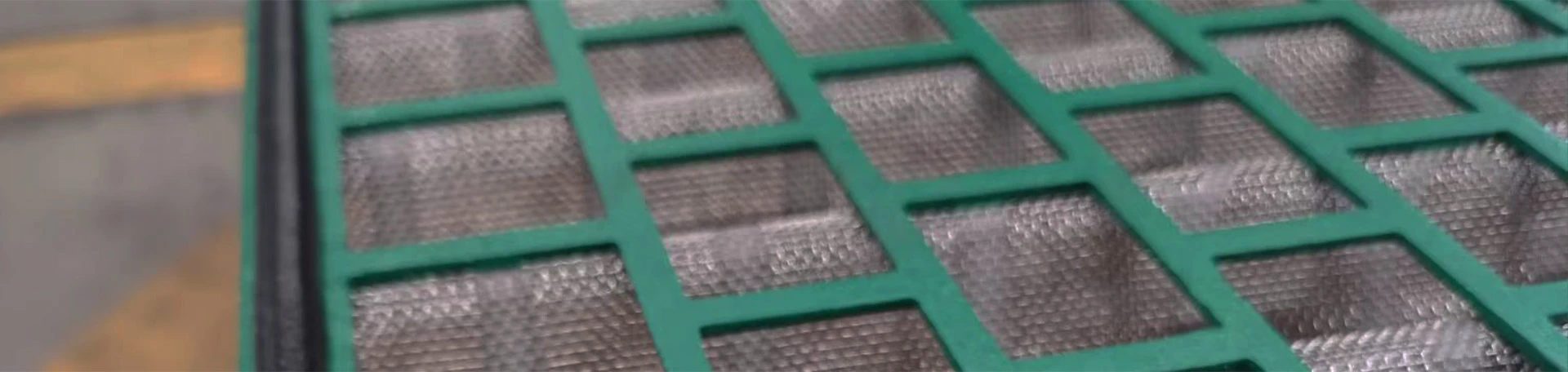

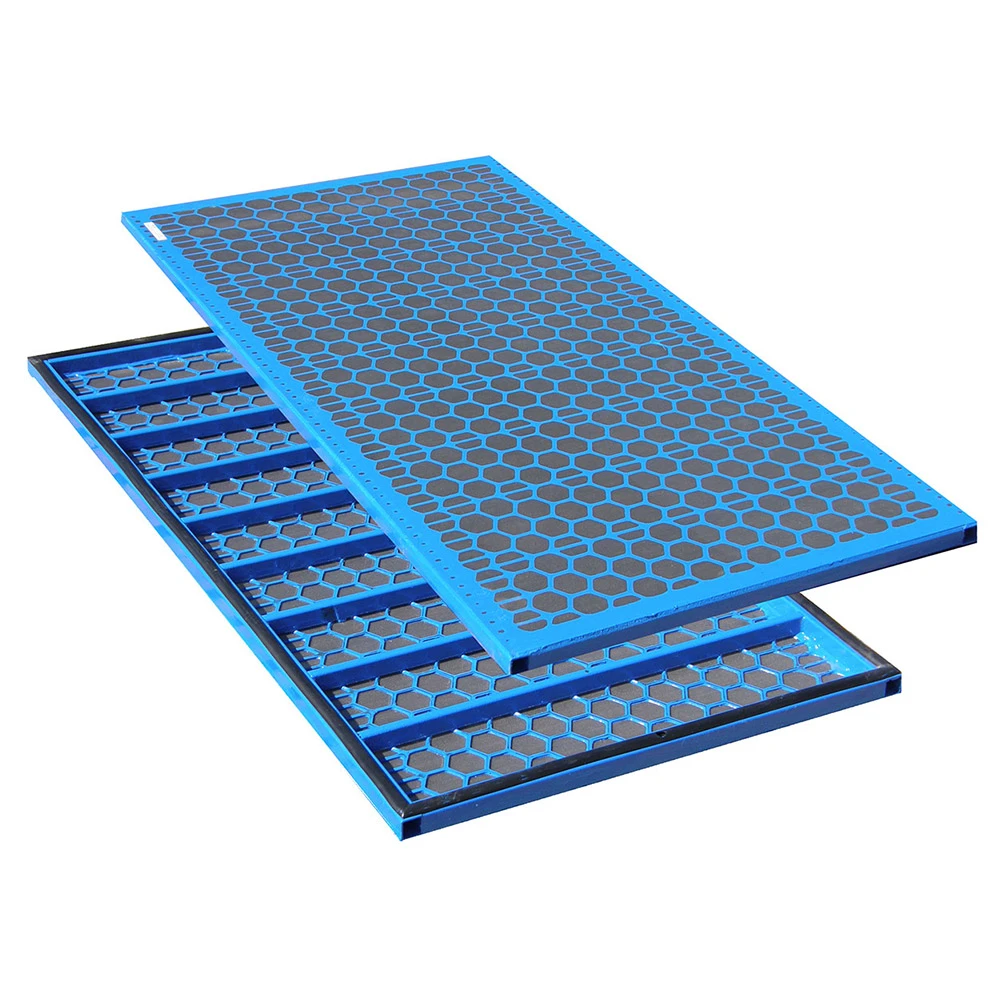

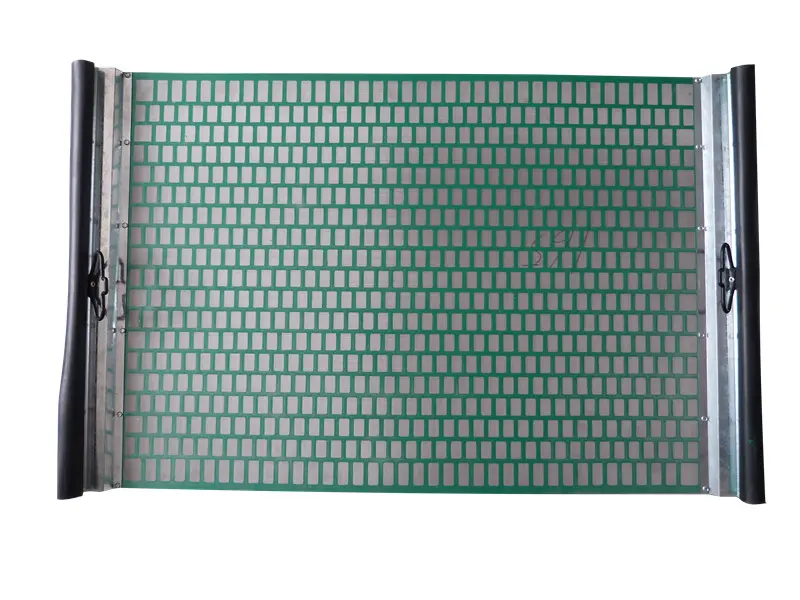

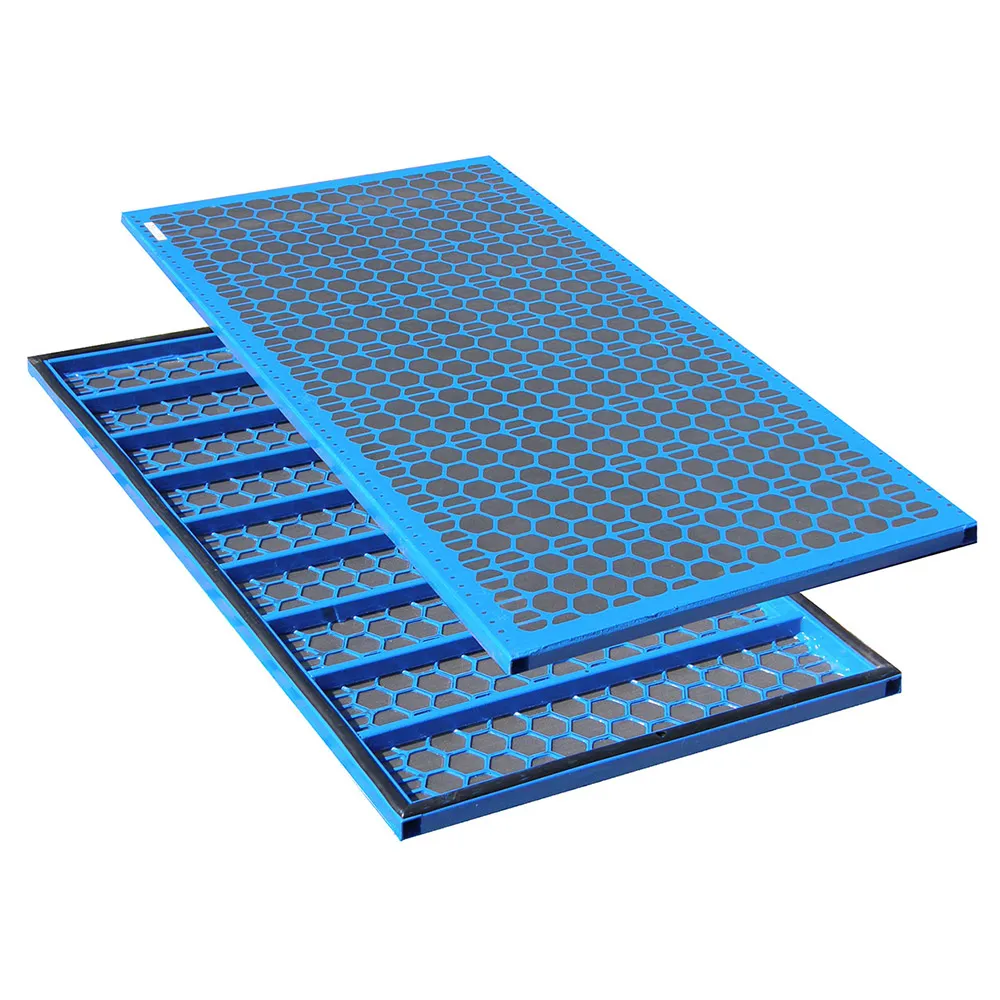

Technical Innovations Driving Shaker Screens

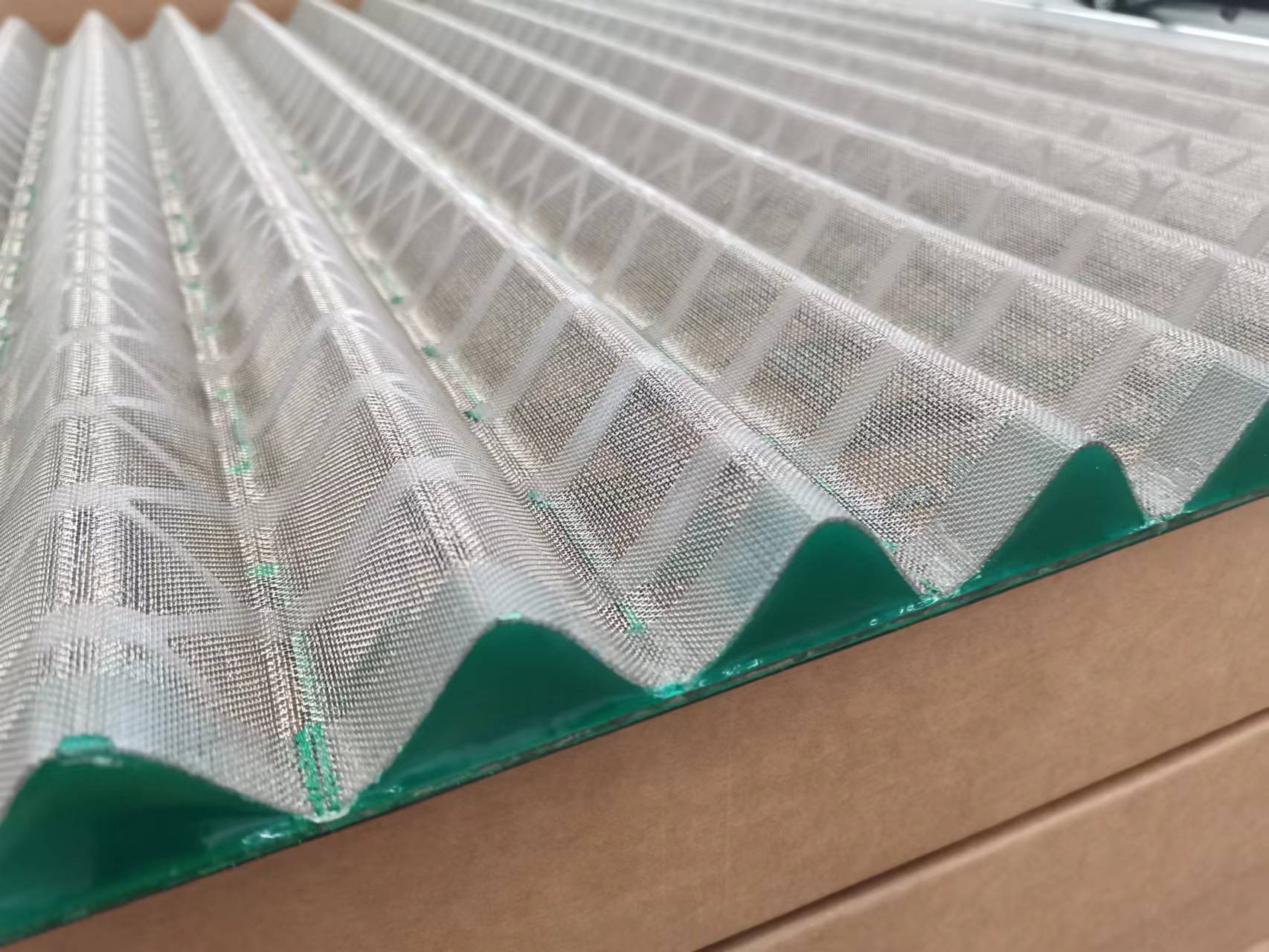

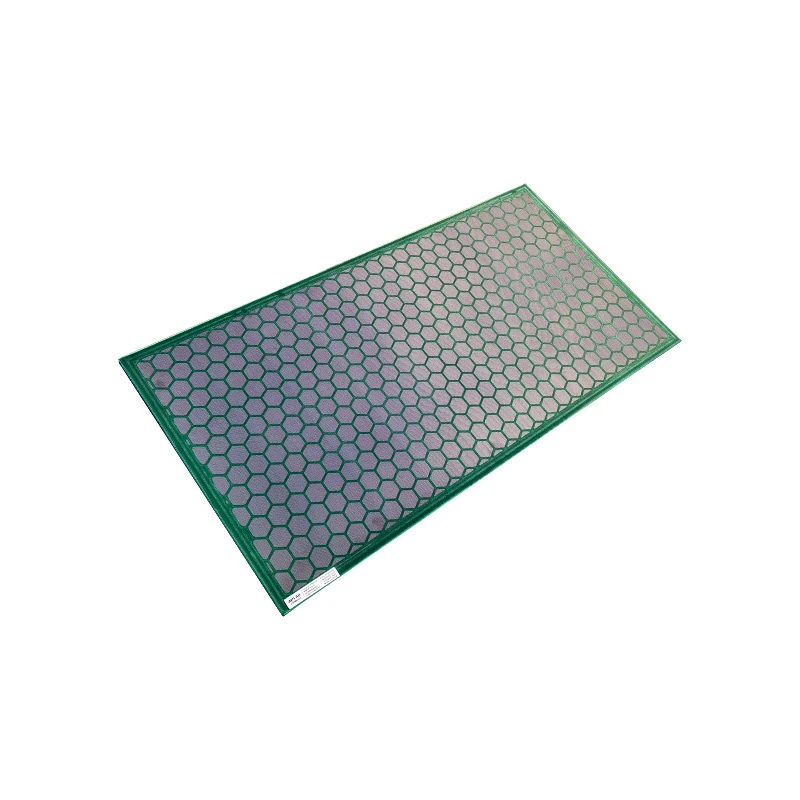

The technical advantages underpinning modern shaker screens influence both their adoption rates and pricelists. Composite frame screens now dominate 47% of total orders by providing up to 35% longer service life versus conventional steel mesh. These innovations reduce restart downtime, operational costs, and maintenance. Micro-mesh fabrication, layered screen construction, and corrosion-resistant coatings are transforming field performance. For example, Brandt’s latest composite screens offer a three-phase design—integrating a coarse top layer, intensive middle weave, and ultra-fine support—which collectively enhances throughput by 18% and maintains separation consistency even in high-volume mud systems.

These advances justify industry premiums and inspire tailored solutions. Operators consistently seek screens supporting finer mesh sizes (API 200+) to address ultra-fine particle removal without sacrificing flow rate. Enhanced frame structures with reinforced ribs deliver up to 14% higher impact resistance, catering to regions with abrasive drilling conditions. As screens grow more technologically advanced, their pricelists start reflecting not only build quality but the anticipated performance return over lifespan.

Manufacturer Comparison: Selecting the Optimal Solution

When evaluating shaker screens, procurement departments must weigh price, reliability, and after-sales support. Leading manufacturers, including Brandt, MI-SWACO, and GN Solids Control, maintain their competitive edge by offering product warranties, rapid lead times, and extensive inventory support. For drilling rig operators, screen pricing can make up to 7% of the entire solid control bill annually, creating significant budgetary impact at scale.

Various factors—like procurement volume, regional tariffs, and customization—cause prices to fluctuate by as much as 19% across international contracts. Notably, Brandt prioritizes OEM-grade certifications and testing, reflected in longer average screen longevity. Conversely, some emerging manufacturers like Deruite capitalize on price economy but may require greater bulk purchases or incur longer delivery schedules. By referencing side-by-side pricelists, stakeholders can identify which supplier balances affordability, response speed, and technical innovation most effectively.

Customization Strategies in Shaker Screen Procurement

The shaker screen market now emphasizes customization as a key differentiator. Industry buyers frequently request tailored mesh counts, reinforced screen frames, and proprietary cut-point geometries. For example, a Middle Eastern operator recently required a batch of composite screens designed for 105°C surface temperatures and 2.8x normal frame load, extending service intervals by 26%. Such bespoke orders tend to influence pricing by up to 35% over baseline entries, but deliver exceptional process resilience.

Screen manufacturers increasingly provide digital traceability, barcoding, and QR-based maintenance logs to streamline asset management. These innovations support operators implementing predictive maintenance and total cost of ownership (TCO) optimization. By collaborating directly with technical engineering teams, buyers unlock fit-for-purpose screens aligned with local regulations, drilling fluids, or particulate profiles. Leading procurement strategies now weigh not only the initial unit price, but also downstream effects on operational efficiency, replacement cycles, and HSE compliance.

Real-World Application Cases Influencing Pricelist Choices

Practical deployment of shaker screens reveals how nuanced pricelist decisions generate measurable business outcomes. In a 2023 North Sea project, an operator selected high-precision Brandt composite screens at a premium, reducing non-productive time (NPT) by 14% and saving approximately $76,000 over the drilling campaign. In West Africa, a cost-constrained campaign prioritized Deruite steel screens, extending supply intervals but ultimately facing elevated replacement frequency due to more aggressive wellbore conditions.

Another onshore application in Canada mixed OEM Brandt and third-party screens based on specific well phases, achieving best-in-class cost-per-foot drilled metrics. The ability to toggle between pricelist tiers based on technical and financial risk sparing yielded cumulative savings above 12%. These examples highlight the intertwined roles of engineering, procurement, and supply chain, reaffirming why a granular approach to the industrial shaker screen pricelist is always warranted.

Summing Up: Brandt Shaker Pricelist Drivers and Future Prospects

The brandt shaker pricelist encapsulates a complex interplay of technical excellence, supply consistency, and tailored support. As digitalization and sustainability gain traction within the solids control market, future screens will likely offer even greater smart monitoring, eco-friendly materials, and predictive price models. Buyers who rigorously evaluate vendor portfolios—balancing initial acquisition cost with operational and maintenance factors—are best positioned to maximize both short- and long-term value. By continuously benchmarking the brandt shaker screens pricelist against evolving field requirements, organizations equip themselves to maintain competitive edge, safety, and profitability in volatile industrial environments.

(brandt shaker pricelist)