- Introduction to Brandt Shaker Pricelist: Industry Overview and Current Market Trends

- Data Insights: Market Price Evolution and Cost Analysis for Shaker Screens

- Technical Advantages of Shaker Screens in Industrial Applications

- Comparative Analysis: Leading Manufacturers and Their Market Offerings

- Customization and Specification Options for Shaker Screens

- Application Case Studies: Real-world Deployments and Performance Outcomes

- Conclusion: Making Sense of the Brandt Shaker Pricelist for Informed Procurement

(brandt shaker pricelist)

Introduction to Brandt Shaker Pricelist: Industry Overview and Current Market Trends

The demand for advanced solids control equipment, especially shale shakers and screens, has surged globally in recent years, and with this comes a heightened interest in the Brandt shaker pricelist. As drilling conditions grow more challenging and environmental compliance standards become more stringent, the importance of selecting the right shaker screen has intensified. Operators are increasingly scrutinizing costs, technical specifications, and supply reliability. The global shaker screen market was valued at approximately $1.3 billion in 2023, with the oil & gas sector claiming over 70% of the installations. Other sectors like mining, construction slurry separation, and trenchless drilling are fast-growing adopters as well. Knowing the intricacies of Brandt shaker screens pricelist is pivotal for controlling project budgets and maximizing operational efficiency.

Data Insights: Market Price Evolution and Cost Analysis for Shaker Screens

The cost structure of industrial shaker screens, including Brandt and its competitors, has evolved over the past decade, driven by advances in manufacturing technology, raw material prices, and increasing demand for higher mesh counts. Below, a comparative cost data table provides a snapshot of current pricelists across leading manufacturers:

| Vendor | Standard Screen (USD/pc) | High-Performance Screen (USD/pc) | Delivery Time (days) | Annual Volume Discount |

|---|---|---|---|---|

| Brandt | 64–83 | 95–124 | 9–14 | Up to 10% |

| MI SWACO | 67–90 | 107–130 | 10–18 | Up to 7% |

| Derrick | 74–88 | 110–139 | 11–16 | 8% |

| GN Solids | 55–69 | 75–110 | 8–12 | Up to 15% |

| Other OEMs | 44–100 | 67–135 | 13–20 | Variable |

Over the past five years, the average price for standard replacement screens has increased by approximately 17%, mirroring rising steel and manufacturing input costs. The premium for high-performance mesh screens ranges between 40–60% due to longer service life and advanced filtration technologies.

Technical Advantages of Shaker Screens in Industrial Applications

Modern shaker screens deliver far more than fundamental separation. Their performance affects everything from waste volume to drilling speed and fluid recovery rates. Key technical advantages of top-tier screens include:

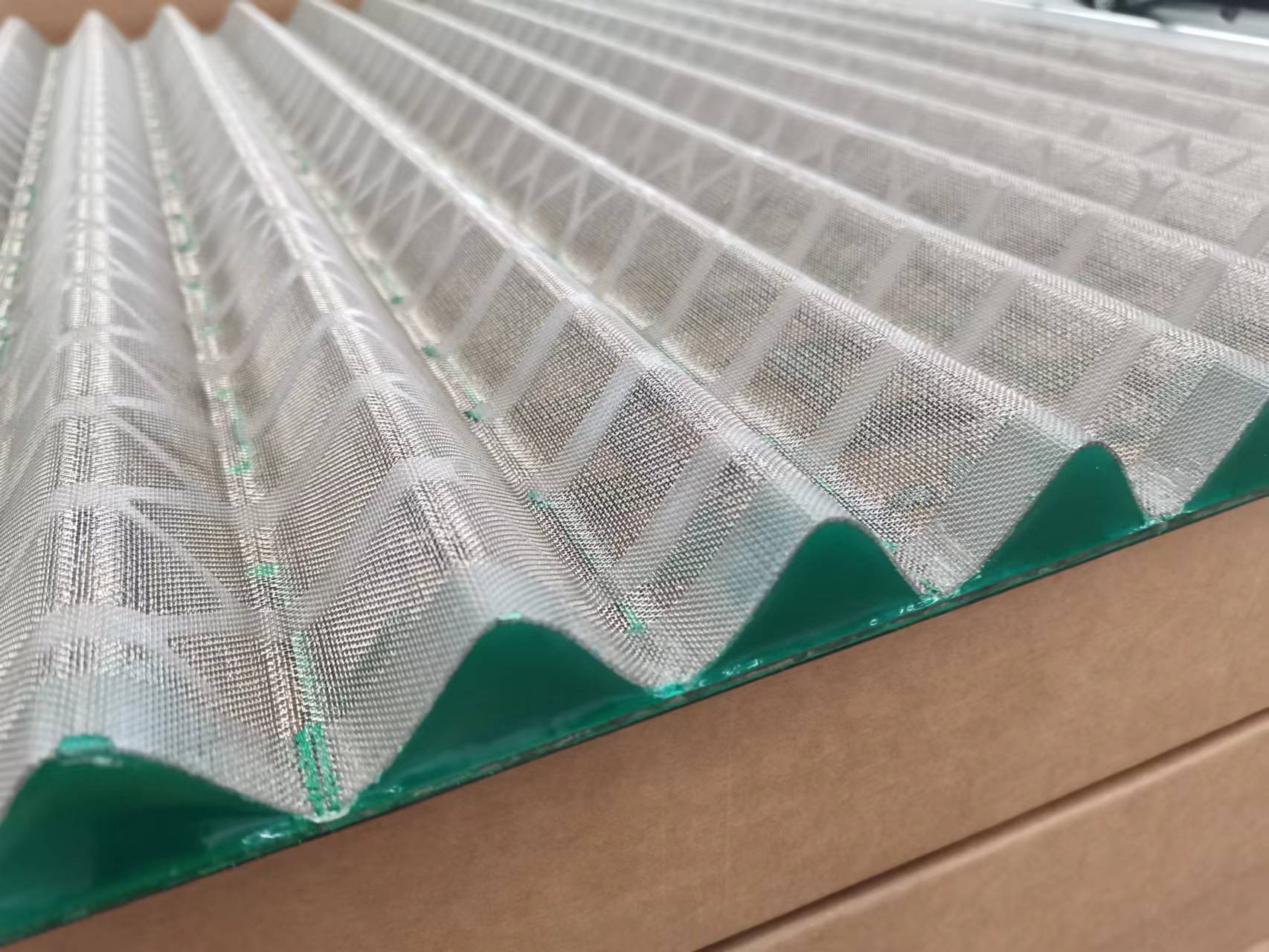

- Enhanced Separation Efficiency: Multi-layer designs and advanced composite frames improve fine solids removal by up to 30% compared to conventional screens.

- Extended Screen Life: Proprietary mesh bonding and wear-resistant coatings extend operational lifespan by 20–70%, reducing replacement frequency and downtime.

- Reduced Fluid Loss: Higher conductance mesh options support faster throughput, minimizing drilling fluid losses and supporting environmental compliance.

- Consistent Performance Under High Load: Reinforced screen frames maintain integrity during surges in solids loading, maximizing productivity in harsh drilling environments.

In industrial contexts such as directional drilling, mining dewatering, and civil projects, the choice of screen specification, frame material, and mesh type directly impact operational costs, total fluid recovery, and project sustainability.

Comparative Analysis: Leading Manufacturers and Their Market Offerings

The landscape of shaker screen manufacturers is competitive, with each supplier offering unique technological innovations, pricing models, and after-sales support. Brandt's portfolio is well regarded for its blend of durability, customization, and reliable logistical support. In contrast, MI SWACO and Derrick prioritize high-end technology integration and broader compatibility with proprietary equipment lines.

GN Solids adopts a value-driven model, targeting emerging markets and providing robust screens at highly competitive prices. The differentiation is further seen in after-market support, warranty terms, and the ability to meet urgent shipping deadlines — critical during drilling campaigns with high consumable turnover.

User feedback and independent benchmark tests consistently highlight Brandt's screens as industry stalwarts in terms of mud-handling capacity, quick-change features, and resistance to delamination. Such factors are instrumental in lowering total cost of ownership even if initial item prices appear moderately higher.

Customization and Specification Options for Shaker Screens

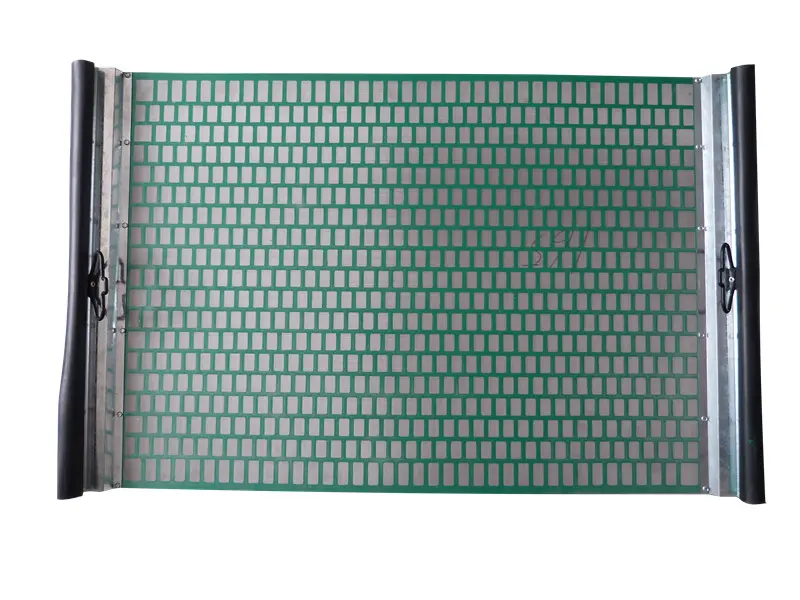

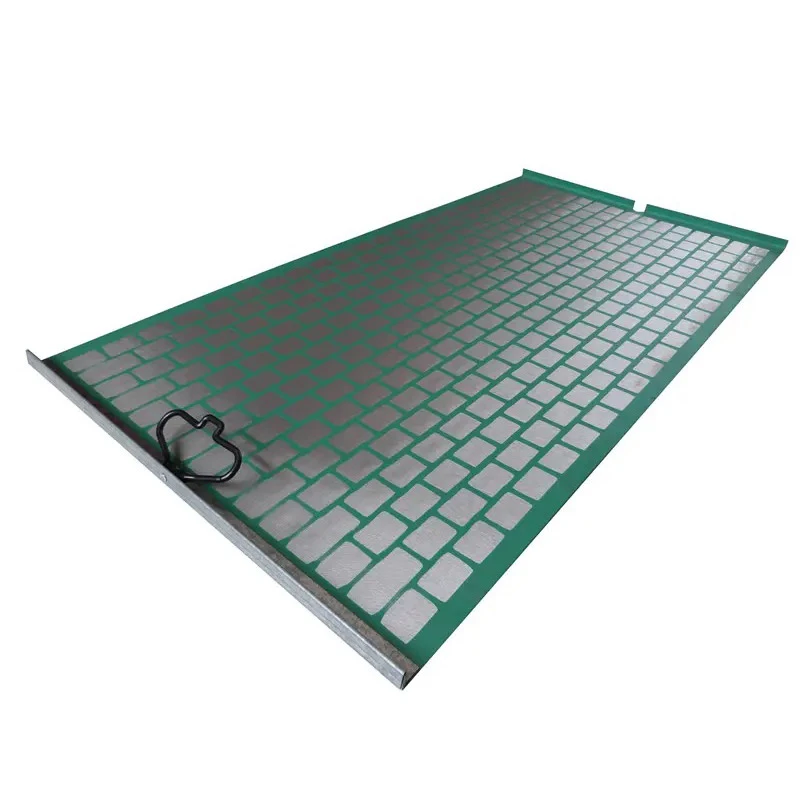

Diverse drilling fluid properties and reservoir conditions demand tailor-made screen solutions. Most major manufacturers, Brandt included, offer a broad catalog of mesh sizes from API 20 up to API 325+, enabling operators to optimize screening according to particle size distributions and field objectives.

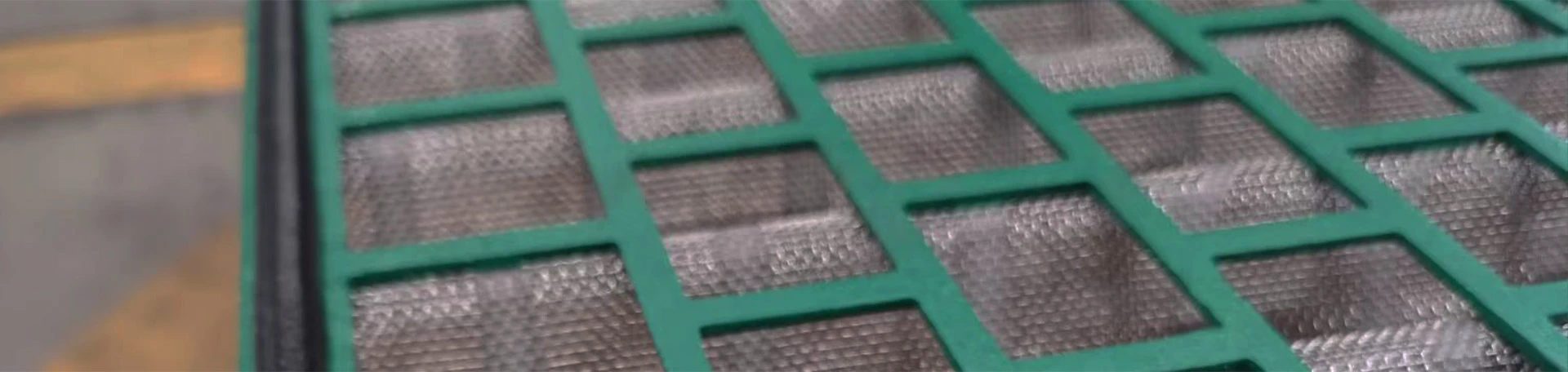

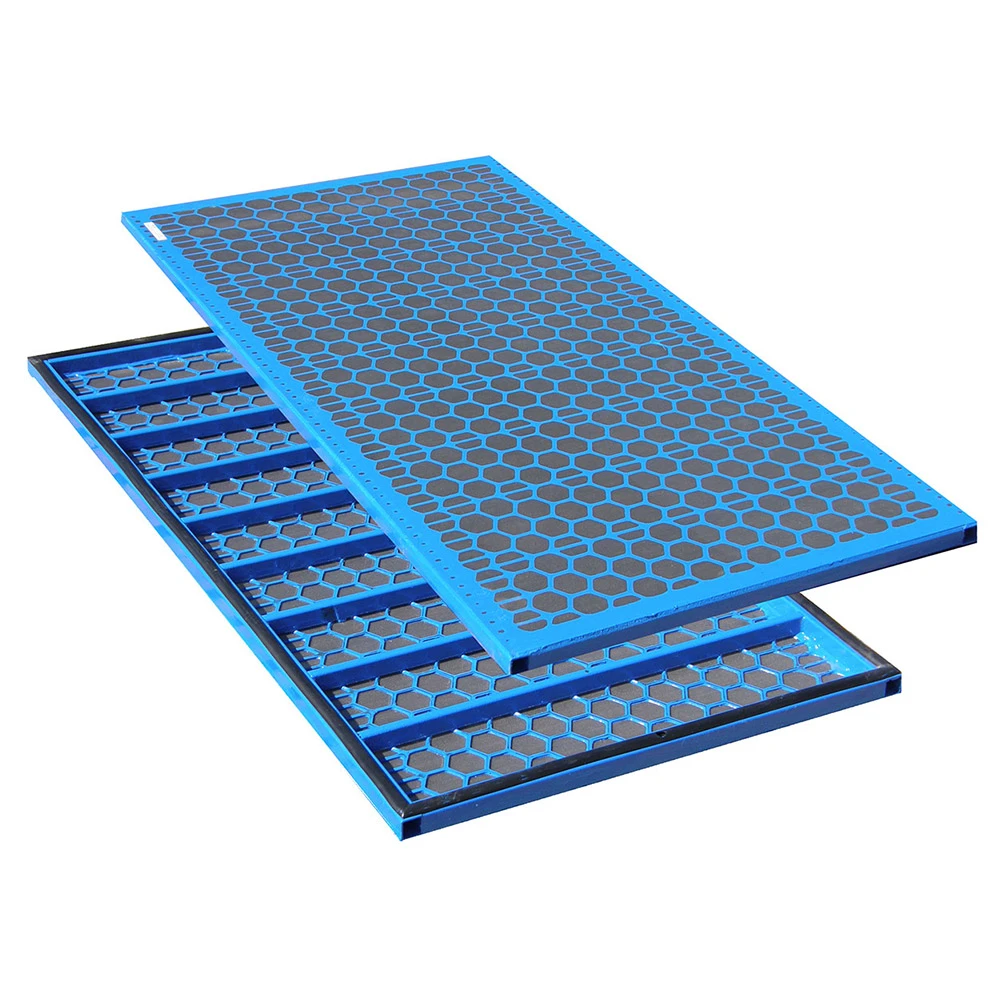

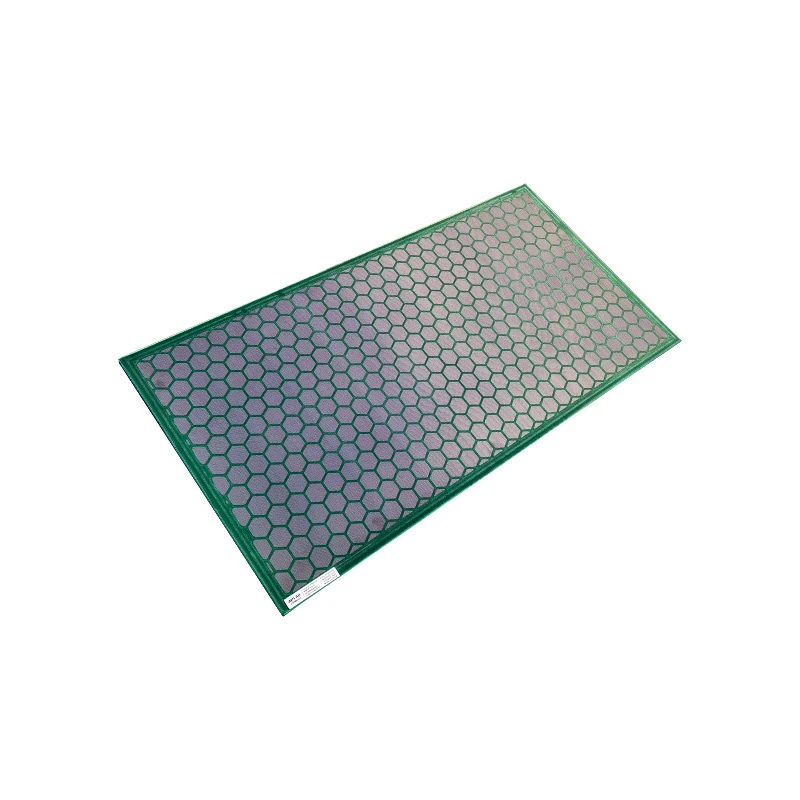

- Frame Material Choices: Options include stainless steel, composite, and high-tensile carbon steel for variable durability and weight considerations.

- Mesh Layering: Screens may be single-layer for high conductance or multi-layer for enhanced cut-point definition and wear resistance.

- Screen Dimension Variants: Custom-fit screens for a vast array of shaker models, from single-deck linear shakers to high-G multi-deck units.

- Accessory Integration: Optional rubber seal grid, vibration dampers, and color-coded frame edges for maintenance efficiency.

Leading suppliers maintain ISO-certified manufacturing systems and often work directly with operators to develop proprietary mesh blends or structural reinforcements specific to harsh or unconventional environments.

Application Case Studies: Real-world Deployments and Performance Outcomes

Demonstrating the operational value of optimal shaker screen selection, several large-scale projects have reported significant performance gains after switching to high-performance Brandt or compatible shaker screens.

- Deepwater Offshore Rig, Western Africa: After deploying composite frame screens with API 235 mesh, fluid loss during peak drilling was reduced by 22%, and screen replacements dropped from 18 to 9 units per well section.

- Lithium Extraction Plant, Chile: Custom-fit screens featuring reinforced frame architecture extended screen longevity by 55%, substantially lowering operational interruptions during high-volume separation cycles.

- Pipeline Construction, North America: By selecting multi-layer high conductance screens, a project achieved a 36% reduction in waste handling charges, as the screens delivered finer cut-points with zero mesh delamination incidents reported over a 7-month period.

Across such examples, payback periods for high-performance screens are often under six weeks, when factoring in fluid savings, reduction in downtime, and improved solids control efficiency.

Conclusion: Making Sense of the Brandt Shaker Pricelist for Informed Procurement

Navigating the complexities of the Brandt shaker pricelist, and broader industrial shaker screen pricelist data, can fundamentally alter project outcomes. In a competitive global market, robust comparative research and careful cost-benefit analysis are integral to procurement strategies. By scrutinizing technical advantages, manufacturer capabilities, and real-world application performance, decision-makers can align investment with operational goals, safeguard project margins, and ensure regulatory compliance. A rigorous approach to reviewing the Brandt shaker screens pricelist ultimately empowers operators to maximize equipment value while minimizing unnecessary expenditure.

(brandt shaker pricelist)